Earl Lee

Thoughts on Lululemon acquiring Mirror

Why this makes sense

Retail distribution: Lululemon will be able to distribute MIRROR in its stores, resulting in much broader reach for the product and ability to hook users via demos. Peloton saw success with this in-person demo model, so MIRROR may too. It remains to be seen how much of a barrier Covid-19 is on this front. Additionally, MIRROR users may be more inclined to purchase Lululemon gear if they see MIRROR instructors wearing Lululemon. I suspect the benefit to be more unidirectional, however, boosting MIRROR product sales but less so Lululemon sales because anyone paying $1,495 for workout equipment probably already purchases high-end workout apparel.

Complementary brand: Both MIRROR and Lululemon are sleek, sexy, and high-end. They're premium products that make the consumer feel good about themselves.

Remain relevant: Fashion moves quickly. Lululemon already faces a crop of upstart athleisure brands. I personally skipped over Lululemon and went straight to brands like Ten Thousand (referral link) and Rhone. This is one way Lululemon can diversify revenue streams while capitalizing on its still relatively strong brand.

Connected apparel: Certainly a long-shot, but Lululemon could build connected apparel that complements MIRROR and increases ways of monetizing existing MIRROR users. Companies Startups like Athos are pioneering the edge here, but MIRROR users could get even richer feedback on their workouts by wearing apparel that utilizes electromyography to sense muscle activation. At face value, I think such functionality provides marginal benefit to the MIRROR user who likely don’t care that much. The value of MIRROR is likely more in the motivation it provides and the positive emotions associated with the experience—everything from breaking a sweat to having a nice, high-tech furnishing for your home.

Risks

Paying Covid-19 revenue: MIRROR’s 2020 revenue may be unduly propped up by temporary buyers driven by Covid-19. These users may end up churning or returning the product, meaning its existing ARR and revenue growth is not the same quality as MIRROR revenue and growth last year.

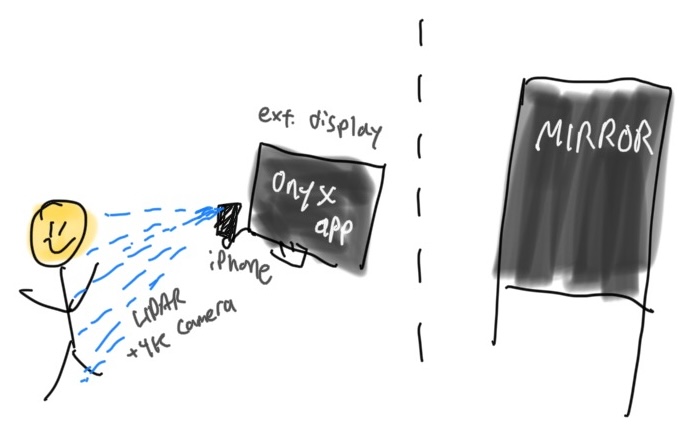

Competition heating: Besides the obvious competition—Peloton, Tonal, Tempo, etc—startups such as Onyx can provide a similar experience to MIRROR but for a fraction of the cost. Onyx uses computer vision to provide live feedback on your form and video-based workouts, similar to MIRROR. One can imagine what the experience might look like if you couple LIDAR sensors and 4K cameras on iPhones and iPads with a larger monitor screen. The large monitor would basically be a mirror, and the iPhone/iPad visual sensors would provide all of the sensing necessary for workout guidance (see my crude illustration above). That said, there’s value in simplicity, and a device focused on doing one thing frequently wins out over a more complicated solution.

Transaction details

Lululemon is paying $500M in cash with $50M of it held back as an earn-out over two years. It has over $800M liquidity in cash, a $400M revolver, and another $300M revolver.

With MIRROR's revenue expected to be north of $100M this year, the sticker price sounds reasonable, though I’m curious what percentage of the $100M is recurring revenue versus hardware sales. A simplistic view taking new subscriber contribution ($1,500 for the hardware and $480 for the subscription) as the overall revenue breakdown results in 25% of the revenue being recurring. In reality, that percentage will be slightly higher because of existing subscribers contributing pure recurring revenue. If MIRROR was growing quickly, most of its revenue will be from new subscribers. $25M ARR for $500M cash would imply a 20x multiple. For reference, Peloton is trading at ~16x EV/Revenue. MIRROR is also expecting to break-even or profit in 2021, but again, I wonder what impact the loss of quarantine-driven demand will have on this expectation.

Takeaway

Overall, this was a great exit for a hardware startup that only raised $72M, but I’m not confident it will be a win for Lululemon in the long run. I think if the parent company can let MIRROR run on its own while benefiting from improved distribution, there’s a chance this turns out to be valuable, but I also harbor some doubts that MIRROR, despite its surface-level similarities to Peloton, will see similar traction. One of the reasons Peloton’s social motivation works is that it’s simple. Cycling is easy to pick up and because it’s a single movement, you can elevate one simple metric as the number everyone competes around—Peloton’s output score. This drives peer competition.

It’s harder to do the same when users can do everything from burpees to crunches. To win on an equivalent output score in the MIRROR world, one might simply pick workouts that only ask you to do burpees because those will burn the most calories, increase your heart rate the most, etc. It’s one thing to justify paying for a stationery bike. You can’t replicate the experience without a stationery bike. It’s a whole other thing to justify paying for a nice-looking screen that will show you how to do exercises you could have done without the device.